Step-by-Step: How to Verify and Claim Your Company's Unclaimed Funds

Businesses—not just individuals—are often owed unclaimed funds. This guide shows how to locate, verify, and claim money held by states, with practical tips on documentation, status tracking, and when a Claimant Designated Representative (CDR) can help.

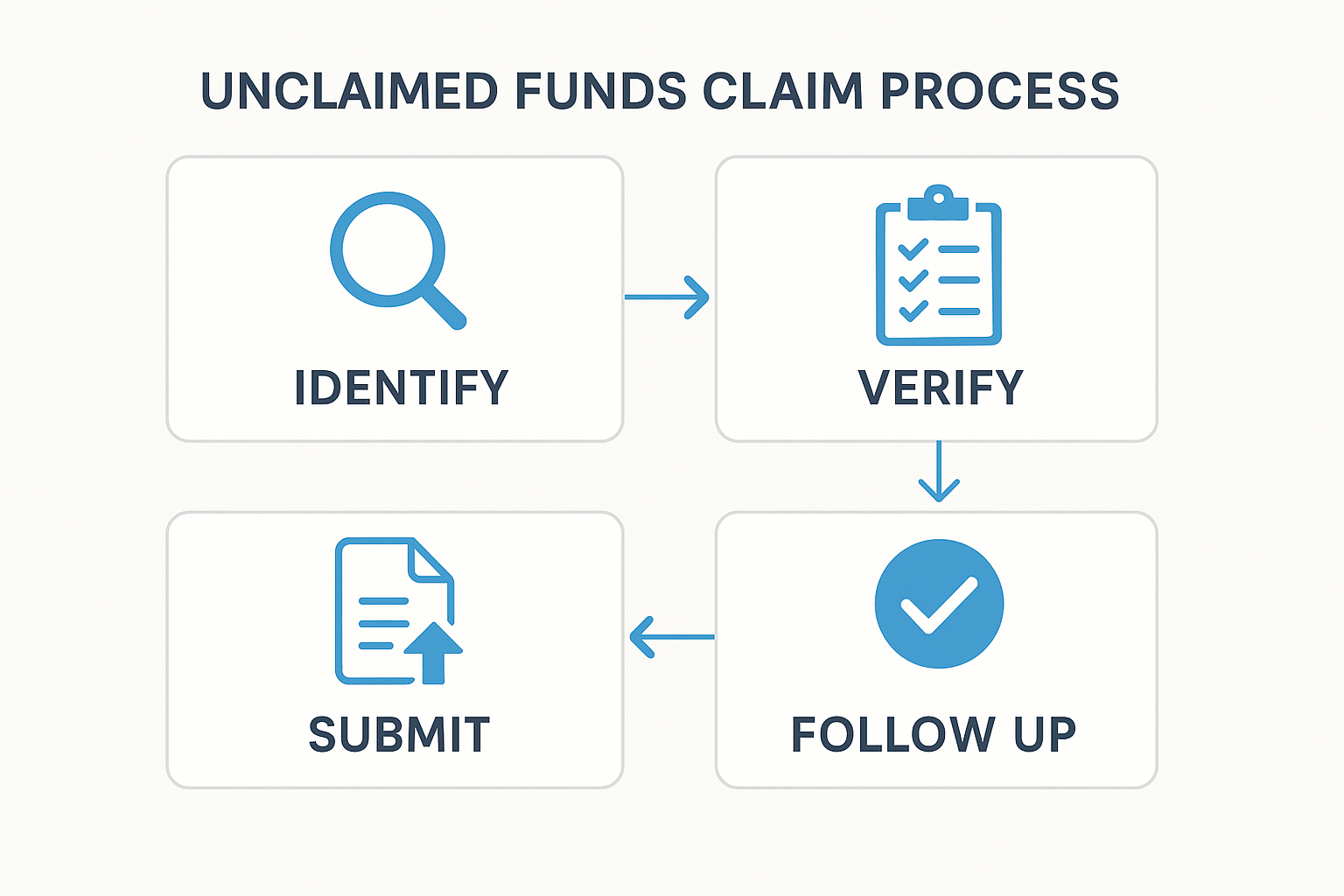

Identify Potential Unclaimed Funds

1.1 Understand what qualifies

"Unclaimed property" can include stale AP checks, vendor credits, AR overpayments, security deposits, dividends, and other amounts owed to your business that sat idle beyond the state's dormancy period. See the National Association of Unclaimed Property Administrators (NAUPA) overview for common types and definitions. [1]

1.2 Search official state portals

Use the NAUPA map to reach each state's official site and search your legal name, trade names, and prior names. If you've operated in multiple states, search each one. [2]

1.3 Review internal ledgers

Audit AP/AR, payroll, and GL suspense accounts for aged items that may have already escheated to a state.

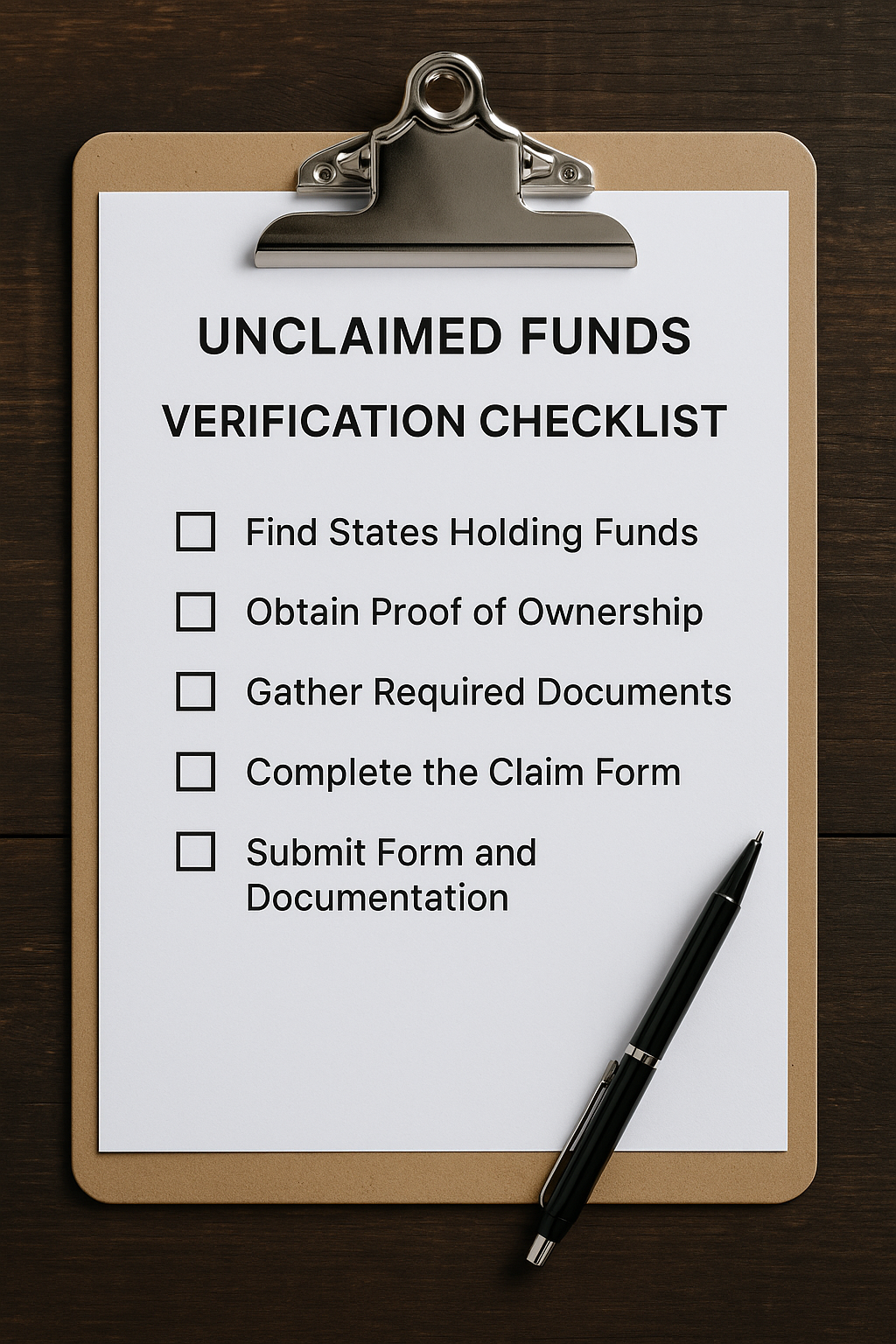

Verify Ownership & Claim Eligibility

Match the state record to your entity. Gather required proofs (e.g., EIN/SS-4, Articles/registration, address evidence, banking proof, authority letters). Many states list documentation checklists in their portals. [3]

Submit the Claim Correctly

Follow each state's portal instructions precisely. Ensure names, amounts, and supporting files match. Formatting errors and missing owner details are the most common reasons for delays or rejections. Use NAUPA-aligned data where applicable. [4]

After submission, retain the confirmation number and copies of everything you uploaded.

Monitor Status & Respond Promptly

Most portals provide status trackers and request additional information if needed. Respond quickly to avoid resets and keep your internal log current.

Build a Repeatable Process

- Schedule periodic reviews of aged credits and stale checks.

- Track activity in a central register (property ID, state, amount, doc status, claim state).

- Document who owns the process (finance/treasury) and escalation steps.

If your claims are multi-state, involve large amounts, legacy entities, or complex proofs of ownership, a registered Claimant Designated Representative can streamline documentation, navigate state nuances, and reduce cycle time and risk.

Talk to a CDR specialist